According to a new law firm survey conducted by CLM, more than nine out of 10 law firms identify talent as a primary struggle. Almost all firms said the talent crush has an impact on clients, cycle time, and trial capacity.

Sixty percent of law firms are turning down work due to capacity issues, and recruiting new attorneys is a top-three-largest issue for law firms today.Retaining talent is equally difficult as attorneys leave insurance work due todissatisfaction with the work, for higher salaries, and in pursuit of a less stressful environment.

The survey was unveiled at CLM’s Litigation Management Symposium in Chicago on Oct. 15, and is part of the work of CLM’s Litigation Management Task Force. The Task Force was created in the summer of 2024 in response to findings from CLM’s 2024 Defense Counsel Study and 2023 Litigation Management Study, conducted in collaboration with Suite 200 Solutions. The Task Force Steering Committee quickly pinpointed several specific areas of concern and formed subcommittees, including the Talent and Recruitment Subcommittee, which commissioned this survey.

Amy Jenkins, a partner with McAngus Goudelock and Courie, unveiled the survey results, highlighting that talent issues are significantly affecting firms’ bottom lines and their ability to represent clients effectively. The Litigation Management Symposium session focused on actionable items where law firms and their clients may find relief. The session also went in depth on some of the issues based on conversations that were had with over a dozen firms from around the country.

Recruitment Challenges and Strategies

Recruiting new attorneys has become increasingly challenging for insurance defense law firms, with nearly every firm identifying it in the survey as either the single largest issue or a top-three issue. Ninety percent of respondents indicated that recruitment is more difficult now than five years ago, with half describing the situation as “much worse.” Recruiting lateral partners was identified as a primary pressure point, which is especially impactful given the enhanced need for partner-level attorneys in the current Nuclear Verdict environment.

In certain regions, recruiting new lawyers directly out of law school has become increasingly difficult due to declining law school attendance. Finding mid-level associates with experience is likened to “winning the lottery” by some firms.

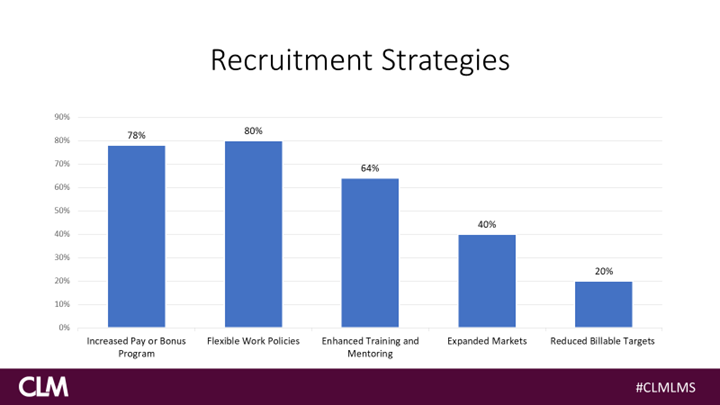

To combat these challenges, firms have implemented various strategies, including increased pay or bonus programs (78%), flexible work policies (80%), and enhanced training and mentoring (40%). Despite these efforts, only about 50% of firms report moderate success, with none reporting significant success.

Retention Challenges and Strategies

Retention of attorneys is another pressing issue, with over 70% of respondents noting increased difficulty compared to five years ago. Smaller firms face greater challenges, with attrition to larger firms being common. Larger defense firms report that most departures are leaving the insurance industry entirely.

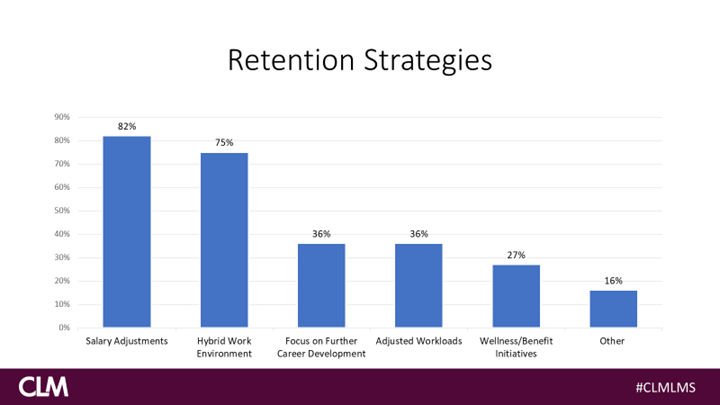

To address retention, firms have introduced salary increases (82%), hybrid work environments (75%), increased career development (35%), and more costly wellness/benefit initiatives (11%). However, similar to recruitment strategies, the success of these efforts is mixed, with only half of the firms finding moderate success.

Reasons for Attorney Departures

The Great Resignation continues to impact the legal industry significantly as exit surveys and feedback highlight why attorneys are leaving at a record pace. The top reasons include higher salaries elsewhere (84%), dissatisfaction with insurance work (60%), pursuit of a less stressful environment (36%), and client/audit pressures (20%). Respondents express frustration with client-mandated non-legal requirements and lower compensation in insurance defense work, driving attorneys to other areas, including the plaintiffs’ bar. Most survey participants (87%) believe the problem will persist or worsen over the next three years.

Impact on Firms

The talent crunch has significant financial implications. Over 60% of respondents report turning down work due to capacity issues, a practice unheard of until recently. In fact, of the firms involved in the discussions related to the survey results, none had ever turned down work before due to capacity until the last two years.

The need for higher salaries and bonuses, coupled with rising recruiting expenses, strains financial resources according to the survey. Firms must absorb costs for new lawyers to familiarize themselves with files, adding administrative burdens. Turnover causes significant financial disruption for law firms. Costly administrative time and expense must be constantly engaged to recruit, interview, process hiring, integrate, and train incoming attorneys. Cases must be reassigned and other resources redeployed to ensure continuity of service obligations to law firm clients.

As a result, firms face difficult decisions about which work to accept, impacting profitability and growth potential. Participating firms indicated that rates, audits, and lawyer satisfaction are primary factors in client selection. Ultimately, this affects anyone working in claims and litigation management as the supply of talented defense counsel is diminished.

Impact on the Client

Recruiting and retaining talent directly impacts a firm’s ability to service clients efficiently. Over 90% of firms report concerns about client service in today’s talent-challenged environment. Delayed client reporting, slower case handling, and reduced trial capacity are operational impacts identified by 70% of respondents.

Despite these challenges, Respondents feel that many clients remain unaware or minimally aware of the true impact staffing issues can have on the firm or the client. This disconnect underscores the need for better communication about the current talent landscape.

Thinking Outside the Box

While law firm pressures and talent issues are real, change will not happen overnight. The industry must collaborate to address these issues, which is the driving force behind CLM’s Litigation Management Task Force. Carrier programs focused on interaction with rising defense counsel stars, including virtual presentations and in-person meetings, have proven to be an effective example of that collaboration. Carriers are also more accommodating of having two attorneys attend depositions and trials, aiding in the development of younger lawyers.

The authorization and use of generative AI, elimination of traditional staffing models, and consideration of large-scale billing model changes are other ways carriers are alleviating pressure on law firms.

Law firms must also be vigilant about internal operations, ensuring adequate training and development for younger lawyers in a hybrid world. Adapting traditional methods to align with new generational priorities is crucial.

“This study is valuable because understanding individualized motivations (eg compensation, professional development, hybrid work) may assist with creating personalized solutions to foster retention” says Kate Dombrowski, vice president and claims general counsel for Selective Insurance.

“We’re at an inflection point in the industry for many reasons including legal system abuse, AI and talent shortages. It presents a unique opportunity for carriers and law firms to work in partnership to implement meaningful change beneficial to all” according to Matt Morrison, vice president of litigation at AmFam Group.

The crisis is real. It is being felt by firms and their clients. There is no single solution. This survey and the ongoing discussions in the industry must serve to find micro-relief points on the pressures firms are feeling, while maintaining the need for efficient representation.

JD Keister is a partner in MGC’s Raleigh Office. He is also part of the CLM Litigation Task Force Steering Committee and a co-chair of the CLM Litigation Management Symposium.