September 14, 2017

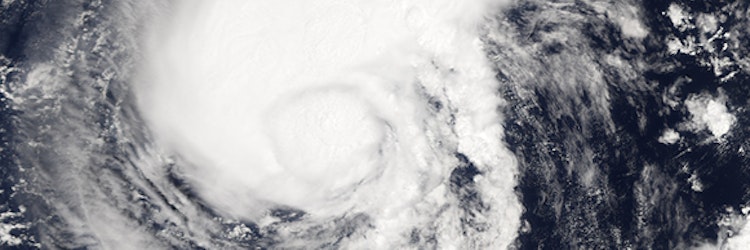

Like every other CLM member and fellow, I was glued to my phone all weekend when Hurricane Harvey started his slow crawl and stall along the Texas Gulf Coast. In the days leading up to landfall, it was clear that as the category levels continued to rise, the prospects for disaster were rising, too. Sadly, it didn’t disappoint; the images that flashed across my screen were mouth-opening.

News reports weren’t any better. CoreLogic’s initial analysis on the flooding taking place in Houston was a punch in the gut: Fifty-two percent of residential and commercial properties in the Houston metro area—1.5 million, to be exact—were deemed at high or moderate risk of flooding but are not part of the Federal Emergency Management Agency’s designated special flood hazard area. Properties in this special area must maintain flood insurance if a federally insured mortgage is involved; those outside are not required to carry it. I think we all know where this is going.

During times like this is when our industry must shine. We’ve come a long way since Hurricanes Katrina and Rita, two 2005 storms that are likely to be put back under the microscope, and we have to take those lessons learned to heart in the weeks, months, and years following Harvey. Certainly, we have better processes, improved technology, and clearer policies, but the way in which we handle our claims and the customer service we provide in these important weeks ahead of us will determine our success or failure.

One thing for certain is that CLM is willing to put our money where our mouths are. As most of you know, CLM’s annual conference is scheduled for Houston beginning on March 14, 2018, and we will be there in person to help with the recovery and show our support for a devastated city. During disaster and difficult times, it’s imperative for us all to stand together and show our support in every way possible.